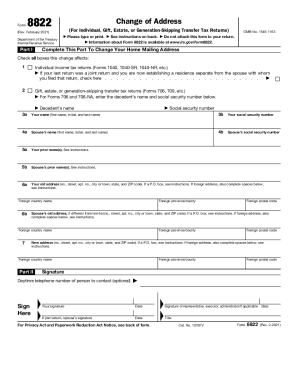

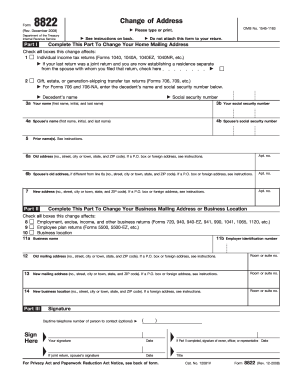

Who needs IRS form 8822-B?

Business entities and taxpayers must file Form 8822-B in order to notify the United States Internal Revenue Service about a change of their business mailing address, their business location, or the identity of their responsible party. The full name of the 8822-B Form is

Change of Address or Responsible Party -- Business.

Is the IRS Form 8822 accompanied by any other forms?

There is no requirement demanding any kind of accompaniment to form 8822-B. However, if the taxpayer’s representative is filing the Change of Address or Responsible Party Form for the taxpayer, a copy of the Taxpayer’s power of attorney must be provided as an attachment.

How long should the Form 8822-B processing take?

As a rule the duration of the Address or Responsible party Change Form processing procedure can take up to 6 weeks, not usually more.

How to fill out the IRS Form 8822-B online?

The first thing to indicate on the Form 882B is whether the submitter is a tax-exempt organization.

The next part of the form is a checkbox asking about the possible effects the change may have (employment, income or employee plan return, business location, etc.)

Having made the necessary checkmarks, it is mandatory to provide the following details:

-

Business name

-

EIN (Employer identification Number)

-

Full old mailing address

-

New mailing address

-

New location of business

-

New responsible party’s name and SSN, ITIN or EIN

-

Signature

Where to submit the completed 8822-B Change of Address Form?

At the bottom part of the Change of Address or Responsible Party Form there are instructions on where the form should be submitted when fully completed depending on the state of residence or where business is done. In fact, however, there are only two acceptable addresses of the IRS offices: Cincinnati, OH 45999-0023 or Ogden, UT 84201-0023.