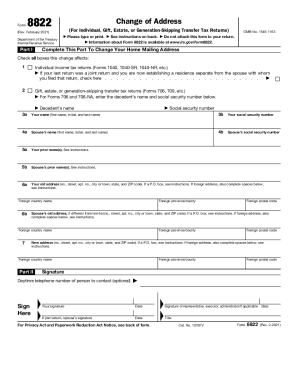

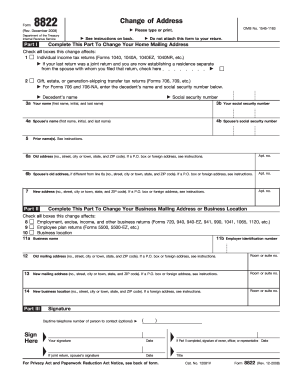

IRS 8822-B 2018 free printable template

Instructions and Help about IRS 8822-B

How to edit IRS 8822-B

How to fill out IRS 8822-B

About IRS 8822-B 2018 previous version

What is IRS 8822-B?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

FAQ about IRS 8822-B

What should I do if I need to correct errors on my IRS 8822-B after filing?

To correct mistakes on your IRS 8822-B, you should submit a new form with the correct information. Clearly mark the new submission as an amended form. Keep records of both the incorrect and corrected forms for your records.

How can I track the status of my IRS 8822-B after submission?

To verify the receipt and processing of your IRS 8822-B, you can contact the IRS directly or use their online tools, if available. Note down your confirmation number if you e-filed to help expedite inquiries.

Are there specific common errors to avoid when submitting the IRS 8822-B?

Common errors include providing incorrect identification numbers, failing to sign the form, or leaving out essential information. Double-check all entries to ensure they match your official records, which can help avoid processing delays.

What should I do if I receive a notice after submitting the IRS 8822-B?

If you receive a notice regarding your IRS 8822-B, read it carefully to understand the IRS's request or concern. Gather any requested documentation and respond promptly to avoid complications. If unsure, consulting a tax professional may be beneficial.

See what our users say